If there is no receivable there will be no record on sales journal. Ma’am Doris esperanze I am an Certified Accounting Book keeper, a practitioner.

Predominantly there are 3 different types of ledgers; Sales, Purchase and General ledger. The act of equalizing the total of both the sides by adding debit balance in the credit side and the credit balance in the debit side is called balancing. Thereafter the amount of difference is added in the deficit side to equalize both sides. This sort of difference between the two sides of accounts is called balance. Every leaf of the account is divided into two equal parts by a bold vertical line or two sharp vertical lines.

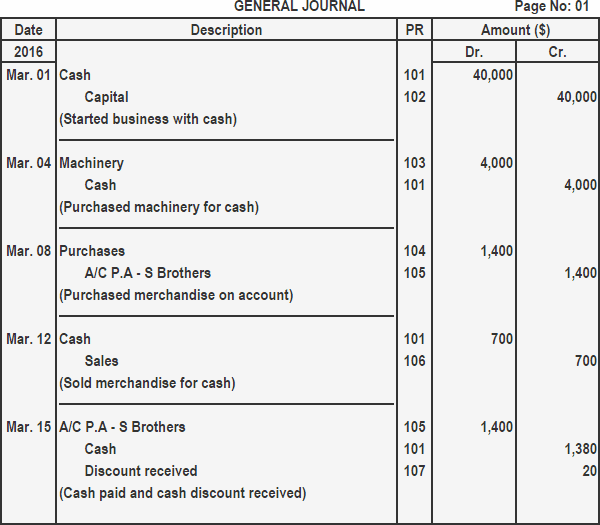

A general ledger represents the record-keeping system for a company’s financial data with debit and credit account records validated by a trial balance. The general ledger provides a record of each financial transaction that takes place during the life of an operating company.

The net result is that both the increase and the decrease only affect one side of the accounting equation. The trial balance is a report that lists every general bookkeeping and its balance, making adjustments easier to check and errors easier to locate. The general ledger is the foundation of a company’s double-entry accounting system.

The general ledger holds account information that is needed to prepare the company’s financial statements, and transaction data is segregated by type into accounts for assets, liabilities, owners’ equity, revenues, and expenses.

Here’s what you need to know about this stalwart of business bookkeeping. The general ledger has been around since the days when the abacus was cutting-edge.

On the other hand, in value-based accounting (e.g. current cost accounting) accounting data is not bias-free because the value may mean different things for different persons. According to the Objectivity Principle, the accounting data should be definite, verifiable and free from the personal bias of the accountant. The practice of appending notes to the financial statements has developed as a result of the principle of full disclosure. The financial statements must disclose all the relevant and reliable information which they purport to represent so that the information may be useful for the users.

Now let’s look at the other side of the transaction – the Loan account. The trial balance is prepared by using a general ledger, whereas trial balance is not prepared by using a general ledger. GL control sub-ledger, whereas Sub-ledger is part of the general ledger. Chart of accounts, whereas sub-ledger does not have charts of accounts. Blog Read marketing, sales, agency, and customer success blog content.

According to this principle, the financial statements should act as a means of conveying and not concealing. Matching does not mean that expenses must be identifiable with revenues. This concept calls for ledger account an adjustment to be made in respect of prepaid expenses, outstanding expenses, accrued revenue, and unaccrued revenues. It excludes the amount collected on behalf of third parties such as certain taxes.

Liabilities are classified as current or long-term. Tangible assets are physical entities that the business owns such as land, buildings, vehicles, equipment, and inventory. The amount of the transaction is recorded in this column. Reconciliation is an accounting process that compares two sets of records to check that figures are correct and in agreement. Accounting records include all documentation involved in the preparation of financial statements or records relevant to audits and financial reviews.

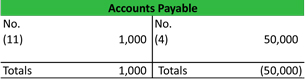

For example, Accounts Receivable may be made up of subsidiary accounts such as Accounts Receivable – Customer A, Accounts Receivable – Customer B, Accounts Receivable – Customer C, etc. Try KPMG Spark bookkeeping outsource professionals. Using their special online software they will process your books, file your tax returns and keep in touch. Cost of Sales are basically any item, parts or service that a business has specifically purchased in order to fulfill a customer’s order or requirements. The new account will appear in the ledger, according to its type and also according to its status as either a child or parent account.

With technological advancements however, most accounting systems today perform automated posting process. Nonetheless, the above example shows how a ledger works. Expenses are usually the longest list found in the Chart of Accounts (yes, those pesky items that reduce the profit!), and are usually kept in alphabetical order. box, which will prevent any transactions from posting to this account (typically applies to a parent account).

This leaves us with a balance on the credit side of $9,000. High five amigo – you’ve completed your first normal balance ledger. Now that we’ve entered all our journals into our ledgers let’s take a look at what to do next.

An accounting error is an error in an accounting entry that was not intentional, and when spotted is immediately fixed. – Private ledger consists of accounts which are confidential http://esignon.pl/sage-intacct-accounting-software-cloud-erp/ in nature such as capital, drawings, salaries, etc. These accounts are only accessible by selected individuals. Cash Sales and Cash Purchases are booked into the Cash Book.

The left side of it is the debit side and the right side is the credit side. But it is not possible to determine the complete results of transactions from the journal. Balance brought down is the opening balance assets = liabilities + equity is in respect of the receivable at the start of the accounting period. If you spend $20,000 on the business, that becomes part of your credits. However, the value of that business becomes part of your debits.

Fill out the form below to book or request a quote. Alternatively please call 0416 088 195